The global fintech market continues to grow at an impressive rate adding more innovative products and services to the financial landscape.

Today, fintech startups are challenging traditional banks in virtually every aspect of finance. Be it loans, credit scoring, payments, insurance or digital banking, fintech has its footprint everywhere.

More financial services certainly bodes well for the customer. But what of the fintech firm?

There are nearly 21,000 fintech companies all over the world with 8,775 in the US alone.

This obviously presents a fintech brand with a marketing problem. How can they differentiate and be heard over the noise? What happens if an experienced competitor adds their product to its own as a feature? How do they create lasting connections?

All these are important questions to answer, particularly now. Since the financial market is only going to become more competitive, your fintech marketing needs to be on point.

Now, there are a lot of marketing strategies out there and it’s hard to tell the substance from the hype. Fortunately, we also have good examples that can help you out here. Here are five of those.

Get long-term ROI.

We help you grow through expertise, strategy, and the best content on the web.

Content Marketing

Banner blindness is at an all time high and online users have become rather adept at closing popups. The message is loud and clear — people want to be helped, not sold to. And this is exactly what content marketing does.

The driving idea behind content marketing is simple. If you do a good job helping your prospects instead of pushing your products on to them, they’ll reward you with their business.

To do this, you need to share your insights through educational, entertaining content. In doing so, you can portray yourself as an authority in your area of expertise.

Content marketing has also proven its worth over and over again. 72% of marketers say that quality content marketing both increases engagement and helps with lead generation.

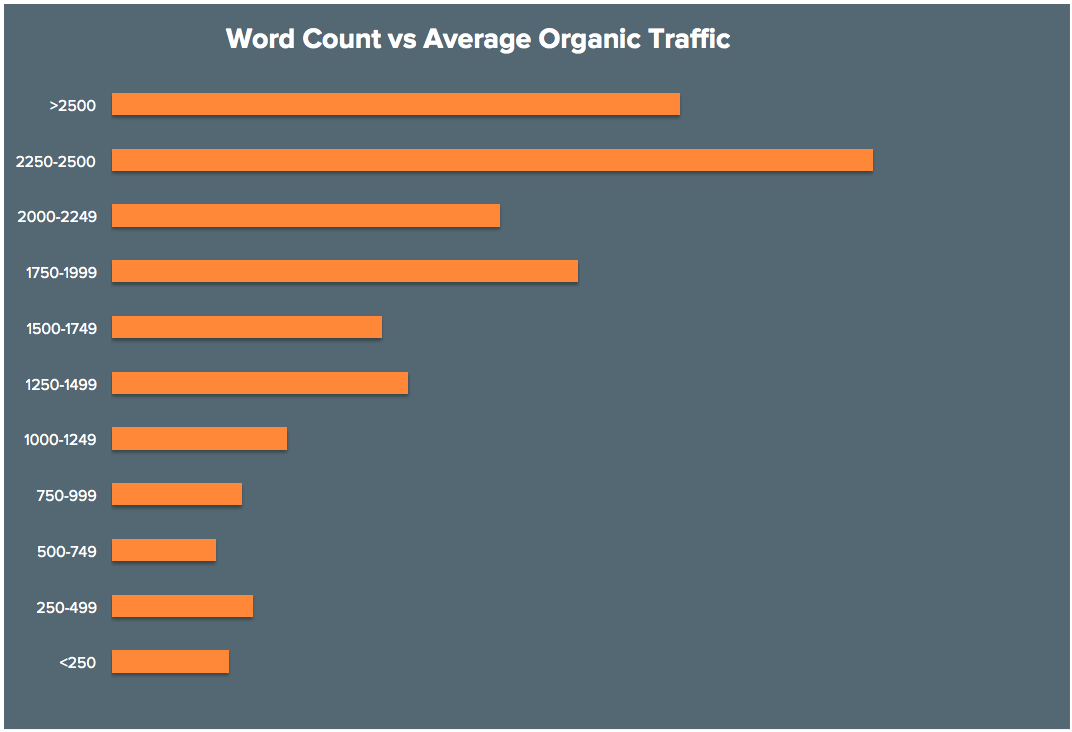

Generally speaking, the more in-depth and well throughout your content is, the better it performs. Online readers spend more than twice as much time on articles over 1,000 words than shorter ones.

Even search engines prefer well written, long-form pieces. Articles that are between 2,250 and 2,500 words long rank the best and get the most organic traffic.

Simply put, the more thorough your content is, the better it performs. And, we have the perfect example to illustrate this point.

Robinhood needs no introduction in fintech. The startup’s goal of making trading accessible to everyone has been largely successful and content marketing played a central role in it.

Robinhood’s content strategy targeted a recurring problem in finance — financial language is almost always unfamiliar and aloof. It has a lot of technical jargon, and uses phrases few would understand.

Such language was problematic to Robinhood since the brand was offering their services to the financially uninitiated. Their content marketing strategy therefore placed special emphasis on keeping finance as simple as possible.

They have a huge “Learn” section with articles that explain concepts as simply as possible. Reader’s needn’t look up terms as every article has plenty of examples and illustrations.

Key takeaway — Complex presentation doesn’t equal professionalism. Keep your content as simple as possible so that more people can relate to it.

Video Marketing

I know what you’re thinking. Finance and video? How are they even in the same sentence together?

After all, isn’t finance really best explained with the written word? It is all about equations, long definitions and heavy concepts.

True that financial services really haven’t used video marketing much. But, that’s precisely what makes video such an enticing choice.

A fintech startup can sneak up on the big names simply by building brand awareness on a platform its competitors have abandoned.

Video also allows you to put a human face on your brand, quite literally. In their quest to look professional, many finance companies often end up coming across as stiff and unapproachable.

Video content marketing can help you overcome this problem. By having a friendly face explain hard-to-grasp concepts, you can forge better engagement with your audience.

Video marketing has proven its worth in virtually every industry.

Viewers themselves have stated they retain 95% of a message if viewed in video. This is particularly important for a fintech brand since it has to share complex ideas in its digital marketing.

There’s also evidence that video is 600% more effective marketing tool than print and direct mail compiled.

The reason video works so well is rooted in biology. The human brain processes visual images nearly 60,000 times faster than text since it’s a fairly recent invention.

Even though video isn’t popular in the fintech industry, there are some great examples of brands using it, too.

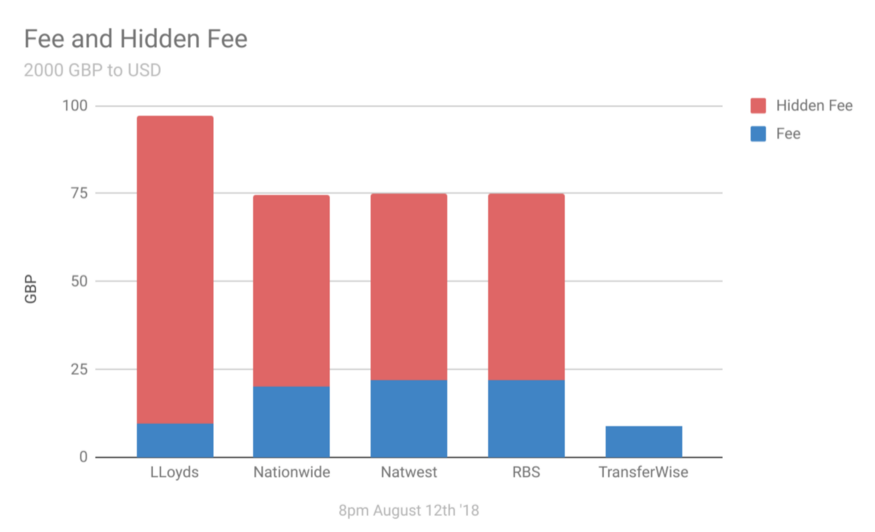

TransferWise’s The Party’s Over video is easily the most memorable example here. The video is clearly inspired by the Dollar Shave Club’s video commercial, but with a unique take.

It targets the hefty exchange rates and fees that traditional financial services charge. It boldly declares their party is over since Transferwise offers the same at a fraction of the price.

Key takeaway — think of your audience’s most pressing problem. Now make videos on how they can solve them. Video gives you the ability to show them how it’s done, too.

Brand Building Through Transparency

Trust is exceptionally important for a fintech business since it’s dealing with people’s money. Traditional finance has left far too many questions unanswered, which a fintech brand can take advantage of.

For instance, no one outside banks really knows how many intermediaries an international money transfer goes to or how the fees are spread.

Banks are also in the habit of purposefully pausing a money transfer so that they can take advantage of fluctuating exchange rates.

Such methods might be fruitful for banks and their affiliates, but hurt consumer confidence. Fintechs can offer better levels of transparency and one-up their older peers.

Greater transparency has more advantages than what meets the eye too. Traditional players can easily copy or reproduce a new fintech’s technological innovations.

But what if you offer near complete transparency into your processes? Established businesses will probably not follow you there.

More emphasis on transparency can even give a fintech company near permanent regulatory immunity. This in turn can protect it from the “shocks” that businesses face every time a new regulation comes about.

Transparency plays a crucial role in marketing. Remember, your prospects aren’t as tech, or finance literate as you are.

So, on the one hand your product’s features will attract them. But, on the other, they will wonder how their money will be handled.

What has this got to do with marketing? Real connections need empathy. And, empathy needs vulnerability.

Always projecting yourself as a winner who has never failed while impressive, won’t convince anyone. It’s too unrealistic.

On the other hand, by openly sharing your failures with the world, you can show that you’re committed to helping despite your flaws.

Monzo is one fintech brand that understands the importance of transparency in brand building. The company, which offers loans and overdrafts, has its fair share of setbacks. But, instead of hiding them and moving on, it chose to share them with its customers.

Monzo’s efforts have paid off handsomely. Not only did the fintech company replace First Direct as the best bank for customer service, and it also raised £20 million in three hours.

Key takeaway: Go ahead and share your failures with your customers, they’ll appreciate it. Don’t overdo it though. Proprietary business knowledge and IP should be off-limits.

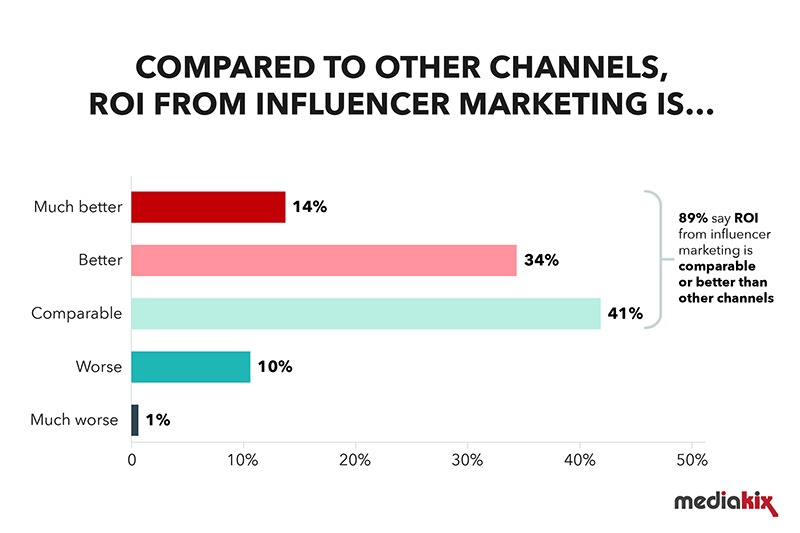

Influencer Marketing

Influencer marketing is another untapped avenue that very few financial institutions are taking advantage of when it comes to online investing.

Influencers are people who have built a social media following. Their fans trust them and often take action based on their advice.

Finance influencers can make ideal fintech brand ambassadors. They can introduce your product to your target audience and help you get instant exposure.

There are already some great finance influencers out there like Dave Ramsey, Jeff Goins, Tiffany Aliche and Mr. Money Mustache. Most have thousands of followers on Twitter, Facebook and Instagram.

A well thought-out strategy which targets multiple influencers can help you get your brand in front of hundreds of thousands of people.

But, don’t stop there either. While finance influencers are the ideal choice, there are others that might help, too. Lifestyle influencers often produce content that can crossover to finance.

For example, if you provide international money transfer service, then look out for travel bloggers and Instagram influencers. The bulk of their audience will be traveling adults who will need fast, affordable currency transfers who might need your services.

The same idea can be applied to virtually any financial service. The online payment firm Klarna came up with a novel way to connect with their customers.

Their Smoooth campaign consists of a variety of videos on all things, well, smooth. The aim was to highlight how easily and smoothly customers could make payments using Klarna.

The fintech brand also partnered with American rapper Snoop Dog who features in one of the videos.

Key Takeaway: Don’t be afraid to reach out to the big names out there. But, don’t ignore the smaller influencers either. Sometimes, it’s the ones with fewer followers who have much more engagement.

Social Media Marketing

With about 3.6 billion people using social media in 2020, can you really afford to ignore it?

But how should a fintech brand be using social media? Unlike companies in most industries, financial services have to consider many regulations and ethical codes too.

But these restrictions only mean your messaging needs to be more strategic, not absent.

The problem with social media is that brands often end up treating it as just another marketing channel. It is anything but.

People hop on to Facebook, Twitter or Instagram to find out what their friends and family are up to, not to buy stuff.

Selling on social media is kind of like an MLM salesman trying to get everyone at a party to join his downline. Such attempts will always be ignored.

Instead, you need to forget your product and just join the conversation your audience is having. Chime in. Share your views. And, let your expertise shine.

What you do and what your brand stands for will inevitably come out.

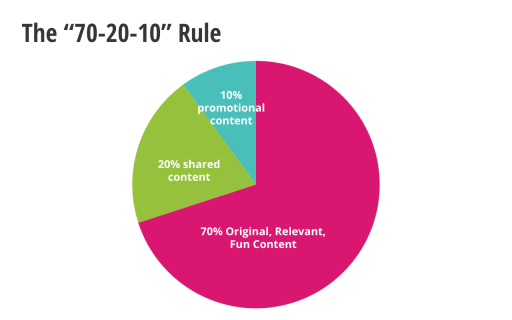

The best strategy for social media is the 70-20-10 rule. Created by Eric Schmidt of Google, the rule states that —

- 70% of the content you share should be educational,

- 20% content can be shared from other sources, and,

- 10% should be promotional.

Think of ways your service can add value to your audience’s lives beyond its core offering. Now create interesting, short-form content on it. Share it with your audience on their preferred social media platform.

Starling Bank is one financial technology firm that knows what it’s doing on social media. Firstly, their blog is replete with content on social media marketing. This shows the company understands the platforms.

Next, they have a well throughout social media content strategy. For example, they have a Money Explained series running on Facebook with small videos on interesting finance topics.

Their text based content is also accompanied with interesting graphics and their videos are professionally produced.

Key takeaway: Make social media a part of your content marketing strategy. Think of all the problems your audience faces your expertise or your product can solve. Now, turn the solutions into content and share it on all the social media platforms your audience is on.If you can make your content or, even better, your products, match the pain points of your clients then you are sure to grab your audience’s attention.

For example, a new way of performing tax returns digitally is being introduced, therefore a need was identified for a guide to making tax digital software for accountants so that they can be completely prepared for the new process.

Conclusion

Marketing in a crowded place is only a challenge if you try and do it like everyone else. Remember, you have an interesting story to share.

Think of the challenges you faced and what drove you to create the product you have today. Chances are your audiences will find the solutions you came up with useful.

The techniques we have shared above are best thought of as avenues to share those solutions with anyone who may need them.

It’s also important to remember that there’s no one correct fintech marketing strategy. All the five methods above work best when used with one another.

Have questions or thoughts on the matter? Feel free to share them in the comments section below.